Equity is a key asset for homeowners and investors looking to grow their wealth in real estate. In simple terms, it is the gap between your property’s current market value and the outstanding balance on your mortgage. As property prices in Queensland continue to rise, many homeowners are sitting on substantial untapped equity that can be leveraged to finance new property developments. But how do you access and use this equity effectively? That is where strategic planning and expert guidance come into play.

Why Queensland is an Ideal Market for Property Development

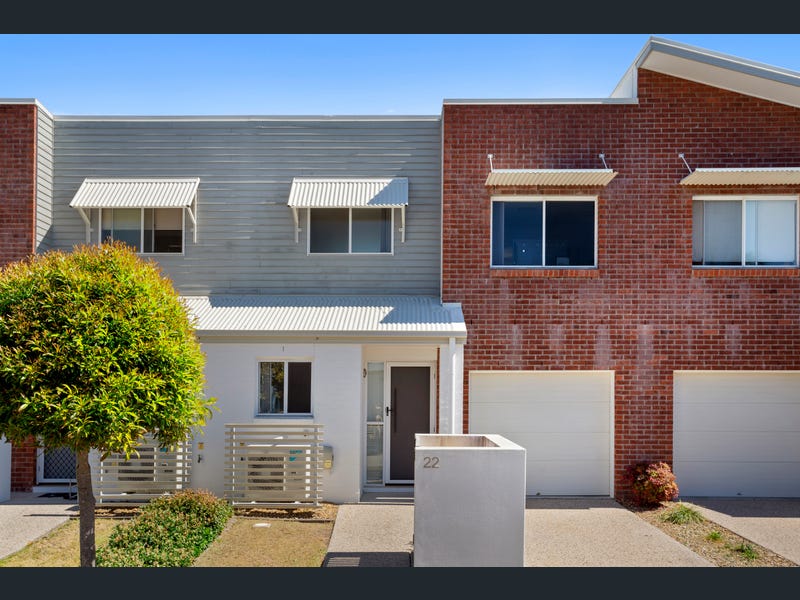

Queensland’s real estate market has been experiencing steady growth, making it a prime location for property investment. With an increasing population, strong infrastructure development, and government incentives, the demand for new housing is on the rise. Whether you are looking to develop residential homes, townhouses, or investment properties, Queensland offers a wealth of opportunities. By using your existing property’s equity, you can finance these developments without the need for large upfront capital.

Steps to Leverage Your Equity for Property Development

Leveraging equity involves a strategic process that requires careful assessment and planning. This is the way to approach it successfully:

- Assess Your Equity Position: The first step is to determine how much equity you have in your existing property. This can be done by obtaining a professional property valuation and comparing it with your outstanding loan balance.

- Talk to a Mortgage Specialist: Not all loans are structured the same way, and accessing equity may require refinancing or setting up a line of credit. Mortgage specialists can help you explore loan options that best suit your investment goals.

- Secure a Loan Against Your Equity: Banks and lenders allow homeowners to borrow against a portion of their equity, typically up to 80% of the property’s value. This borrowed amount can then be used as a deposit or full funding for your new property development.

- Plan Your Development Strategy: Once financing is in place, the next step is to decide on the type of property you want to build. This includes selecting a location, working with builders, and obtaining necessary approvals.

- Work with a Professional Real Estate Agency: Navigating property development requires expert market insights. At Imperial Realtor Group Pty Ltd, we help clients find high-growth areas, connect with reputable builders, and manage the entire property transaction process seamlessly.

Maximising Returns on Your Investment

Using equity to build properties is not just about accessing funds; it is about making smart investment decisions that yield long-term financial gains. Here are some key strategies to maximise your returns:

Choose High-Demand Locations: Areas with growing infrastructure, schools, and transport links tend to appreciate faster.

Build the Right Type of Property: Understanding market demand can help you build homes that attract buyers and tenants quickly.

Consider Rental Yields: If your goal is passive income, ensure that the rental market in your chosen area supports strong returns.

Engage with Real Estate Experts: At Imperial Realtor Group Pty Ltd, we provide end-to-end solutions, from property selection to rental management, ensuring your investment remains profitable.

Turning Equity into Opportunity

Leveraging your home equity to build new properties is a game-changing strategy in real estate. Instead of letting your property’s value sit idle, you can put it to work and expand your investment portfolio in Queensland’s thriving market. With the right financial planning, expert guidance, and market insights, you can turn your equity into a powerful tool for wealth creation. At Imperial Realtor Group Pty Ltd, we specialise in helping clients unlock the potential of their equity and navigate the property development journey with ease. Whether you are an experienced investor or a first-time developer, we are here to guide you every step of the way.